Roundtable Software Newsletter #49, June 25, 2007

|

Want to subscribe to future issues of our newsletter? Click here!

|

|||

In this issue...

| Patch 31 Released | ||||||

| This patch contains minor bug fixes, a few enhancements, and changes for compatibility with the new Windows version of the software. Click here to go to our Patches page where you can read all the details of this patch and download the patch file. | ||||||

|

Click here to download this patch and be sure to read the instructions on how to load this patch.

|

||||||

| UNIX Users: This patch is not available for download from our website. Please contact your dealer to order patch product. | ||||||

| Q&A: Updating A Customized Screen Form | ||||||

| Q: I see Roundtable's latest patch changes the Point of Sale screen form file, which means after I load the patch I'm stuck having to redo all my Screen Builder customizations to program 4 of that module. It's a lot of work redoing my customizations. Isn't there an easier way?

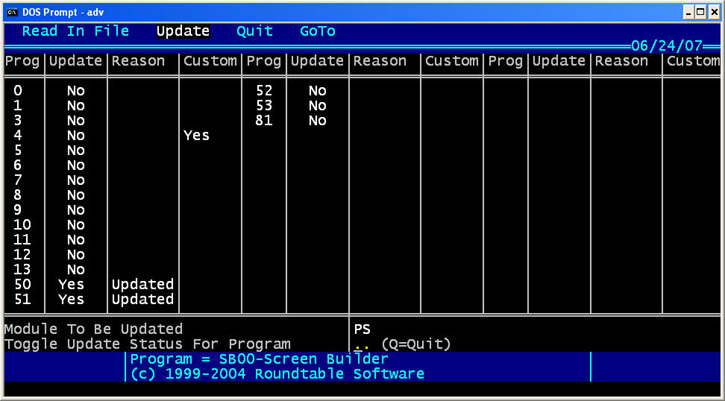

A: Yes there is! If you check the download list, you'll notice that we listed the program numbers in the SCFM files that have changed. In this patch our only changes to Point of Sale were in programs 50 and 51. That's good news for you -- because your customizations were in program 4 you can indeed retain your changes. To do so, go ahead and install the patch. Then go to the Screen Builder module and choose the Update option. Choose PS at Module and you'll see the status screen, similar to the one below. Notice that Point of Sale programs 50 and 51 are shown as updated (the Yes in the Update column, and Updated in the Reason column). That means that we made changes to those programs. |

||||||

|

||||||

| You'll also see that program 4--the program you've customized--has a Yes in the Custom column. That's a reminder that you've made your own changes to the screen of that program. Because Point of Sale program 4 doesn't have a Yes in the Update column you can update your customized SCFM file without losing your changes. If there was a Yes there, you would, unfortunately, lose your changes and have to redo them.

Although you can toggle the update status of the programs here, normally you should not do so. The default settings when you come in should automatically update the necessary programs, and leave all others alone. When you select Q to Quit Screen Builder will update the screens for Point of Sale programs 50 and 51, leaving your program 4 changes alone and you're all set. (If you decided not to run the update at this time, just tab out of the screen). One caveat to this scenario. The Update option depends for its default settings on us updating internal flags on the SCFM files here at Roundtable. If we don't set the update flags then the default settings that you see in the Update option won't be right. We have to admit that we have been lax about this, mainly because our impression has been that no one uses this powerful (but admittedly somewhat confusing) capability of the software. This doesn't mean you couldn't use the Update option, but you'd have to properly set the toggles yourself. But now we are renewing our commitment to properly set the Screen Builder internal flags, and you should find that on subsequent patches we will keep up with things. |

||||||

| Using Go To My PC | |||||

| One of our national dealers, J.P. Williams, recently set up one of his users so that they could use RTS-Advantage on a GoToMyPC connection. He reports that the setup was very simple except for getting remote printers to work. Jim very thoughtfully sent us a PDF document that details the setup process. Click here to review his documentation. | |||||

| Web Commerce Coming Soon! | ||||

| In the near future we will be releasing our new Web Commerce module. This module will allow you to seamlessly interface your RTS-Advantage accounting system with a webstore presence. Our partner in this new venture is PDG Software, a market leader in web shopping cart interfaces.

Our Web Commerce package will act as a two-way conduit, sending out your inventory and customer information to the web store and retrieving sales orders from the web store and putting them in your Order Entry module. If you have been contemplating putting your business on the web, or already have your store on the web but handle all the interfacing manually, this package is your ticket to a trouble-free and profitable webstore presence. And there is no need to wait until our Web Commerce module is released to get the process started. Our software will interface with either PDG Software's Shopping Cart or Web Commerce packages, and you can purchase either of those directly from PDG right now at http://www.pdgsoft.com. Once you've got that end of the setup underway (building the look and feel of your store, or having PDG's professional staff do it for you), you can add in our Web Commerce module when it is released. Be sure to let PDG Software know that you are planning to interface with the RTS-Advantage Accounting Software. |

||||

Roundtable Software Home | Add-On Products | Custom Programming | Support Services | Power Utilities | Partners | What's New | Site Map

|

|

||||

|

||||

| Roundtable Software • 30831 Cove Road • Tavares, FL 32778-5164 (352) 253-9779 • FAX: (815) 572-5446 All contents copyright © 2000-2008 Roundtable Software. All rights reserved. |

||||

map name="subhdr02">